1. Learn how to invest

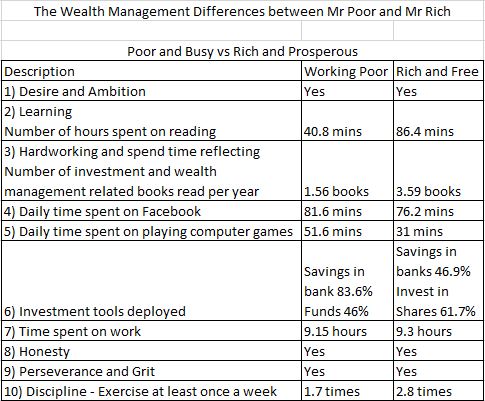

From the above table, the rich are wealthy because the crux lies in willingness to invest time in reading and learning.

2. Time spent on learning

The rich and free spent almost twice the time on learning than the poor.

We have embarked on an journey to achieve financial freedom through our investment portfolio and other streams of income.

Thursday 29 June 2017

Wednesday 28 June 2017

Create your own retirement plan

1. The peril of longer life expectancy

Are you ready? Most of the elderly aged 65 years old and above do not have sufficient retirement sum and they depends on their children and the government to assist. The age group between 45 - 64 years old needs to depend on oneself and may need to extend their retirement age. Hence, a lot of people who are not ready will find themselves working beyond 65 years old.

As one ages and lose the ability to provide, there are other insecurities such as fear of deterioration in health, run out of money and need to take care of spouse.

2. How to get yourself prepared?

A lot of people like to comment on how some entrepreneurs are very thrifty and they become wealthy out of their thriftiness. Actually, their wealth comes from their leverage through business and not through saving on small money such as your favorite daily Starbucks coffee. Thriftiness is good but it can only create small amount of money. In order to create wealth, you need to invest in shares.

In 3rd century BC, Greek philosopher Archimedes discovered the principle of mechanical advantage in the lever. His famous remark with regards to the lever,"Give me a place to stand on, and I will move the Earth." In the world of investment, the pivot is "investment knowledge", with this knowledge, you can choose the right investment tools such as ETFs, bonds, shares, forex, futures, etc. You can gain leverage through investment knowledge.

From our previous post, assume our example character is a 30 years old single man, his annual salary is between SGD 36k to 48k and he is able to save SGD 12k per annum. Assume he works from 24 years old to 30 years old, see below for illustration.

By 30 years old, he should be able to achieve a total saving amount of about SGD 100k. Based on SGD 36k annual income, SGD 12k is a saving rate of 33.3%. If the single man stays with the parents, a saving rate of 33% is highly feasible.

The above illustration is based on a very conservative investment of 4% return.

3. The rich makes more money with money and sometimes with other people's money

After 31 years old, with SGD 100k can be used to pay for property down payment or invest in more shares.

The rich makes more money with money. In 2013, Capgemini and Royal Canadian Bank published a report on 2013 Global Wealth Report and those with asset of USD 1m and above will have access to different financial tools and investment products. They are able to accumulate more wealth than the lower income group.

4. At the start, it is very slow but after 40 km/hr, it will be faster

Remember the momentum theory we learn during our college days, the vehicle/car when it first overcome its inertia, it is moving very slowly and once it hits 40 km/hr, it starts to pick up and can accelerate. The SGD 100k we seen earlier will roll and compound and grow over the years. When the man reaches 60 years old, he will achieve SGD 980,426 and by 61 years old, he will achieve SGD 1,031,644. Imagine if he can change his return from 4% to 10% or increase his saving rate or increase his income.

If he can achieve 10% return, he can achieve SGD 1m by age 47 years old.

If he can achieve 10% return and double his savings, he can achieve SGD 1m by 40 years old.

It is highly doable. All it takes is a bit of discipline and willingness to invest for your future.

Are you ready? Most of the elderly aged 65 years old and above do not have sufficient retirement sum and they depends on their children and the government to assist. The age group between 45 - 64 years old needs to depend on oneself and may need to extend their retirement age. Hence, a lot of people who are not ready will find themselves working beyond 65 years old.

As one ages and lose the ability to provide, there are other insecurities such as fear of deterioration in health, run out of money and need to take care of spouse.

2. How to get yourself prepared?

A lot of people like to comment on how some entrepreneurs are very thrifty and they become wealthy out of their thriftiness. Actually, their wealth comes from their leverage through business and not through saving on small money such as your favorite daily Starbucks coffee. Thriftiness is good but it can only create small amount of money. In order to create wealth, you need to invest in shares.

In 3rd century BC, Greek philosopher Archimedes discovered the principle of mechanical advantage in the lever. His famous remark with regards to the lever,"Give me a place to stand on, and I will move the Earth." In the world of investment, the pivot is "investment knowledge", with this knowledge, you can choose the right investment tools such as ETFs, bonds, shares, forex, futures, etc. You can gain leverage through investment knowledge.

From our previous post, assume our example character is a 30 years old single man, his annual salary is between SGD 36k to 48k and he is able to save SGD 12k per annum. Assume he works from 24 years old to 30 years old, see below for illustration.

The above illustration is based on a very conservative investment of 4% return.

3. The rich makes more money with money and sometimes with other people's money

After 31 years old, with SGD 100k can be used to pay for property down payment or invest in more shares.

The rich makes more money with money. In 2013, Capgemini and Royal Canadian Bank published a report on 2013 Global Wealth Report and those with asset of USD 1m and above will have access to different financial tools and investment products. They are able to accumulate more wealth than the lower income group.

4. At the start, it is very slow but after 40 km/hr, it will be faster

Remember the momentum theory we learn during our college days, the vehicle/car when it first overcome its inertia, it is moving very slowly and once it hits 40 km/hr, it starts to pick up and can accelerate. The SGD 100k we seen earlier will roll and compound and grow over the years. When the man reaches 60 years old, he will achieve SGD 980,426 and by 61 years old, he will achieve SGD 1,031,644. Imagine if he can change his return from 4% to 10% or increase his saving rate or increase his income.

If he can achieve 10% return, he can achieve SGD 1m by age 47 years old.

If he can achieve 10% return and double his savings, he can achieve SGD 1m by 40 years old.

It is highly doable. All it takes is a bit of discipline and willingness to invest for your future.

Tuesday 27 June 2017

Money not enough? That's why you need to invest

In Singapore, the property price is expensive and based on the average salary, it will take a lifetime to pay off the house. Currently, it is still a person's working life time, if it increases to 2 generation to pay off the house, it will become very scary.

1. Life time income of SGD 1,946,880

The below table is from Ministry of Manpower, the average salary in 2016 is SGD 4,056/month. Based on 40 years of working life, the total income is SGD 1,946,880.

1. Life time income of SGD 1,946,880

The below table is from Ministry of Manpower, the average salary in 2016 is SGD 4,056/month. Based on 40 years of working life, the total income is SGD 1,946,880.

2. Life time expenses of SGD 2,704,000

a. Expenses during single-hood

In Singapore, the average man age is 30 years old and woman is 27 years old. Assume that the man graduate when he is 24 years old, he will take 6 years before he get married. Assume that he has an average monthly expense of SGD 2,000. His total expense for 6 years will be SGD 144,000.

b. Expenses from 31-60 years old

Assume that the house is SGD 1m including incurred interest over a lifetime will be SGD 1.25m.

Assume that he bought a car for SGD 150,000 including COE

Assume that he has a kid, the cost of bringing up will be SGD 200,000 (conservatively speaking).

Assume that monthly expense from 31-60 years will still be SGD 2,000. 30 years will be SGD 720,000. I did not take into consideration pay increment and increase in expenses for the illustration.

Hence, total expenses between this age group will be SGD 2,320,000.

c. Expenses between 61-80 years old

Assume that for retirement the man just need to go downstairs to drink kopi o and eat mixed vegetable rice, his monthly expense is only SGD 1,000 including occasional visit to polyclinic for medical expenses.

His expense will be SGD 240,000.

Therefore, this friend of ours will face a shortage of SGD 757,120.

Yes, he can buy a HDB and if he is married, both can help to pay down the house. However, I do not foresee any surplus for a better and earlier retirement.

From the above picture, it shows a conversation between myself and a friend. He was burnt previously before because he invested in get-rich-quick scheme through gold investment. However, he should learn from the mistake and educate himself in terms of investing. He has another good 25 years of working life and with proper planning, he can achieve a fruitful retirement. "Not much money" is not true because he saves a big portion of his income and if there is not much money then it will become a real headache. When he says that he has no interest, he is rejecting me not at the notion of investing. Will anyone be not interested in money? If I tell you that you can make a lot money, will you be interested? Yes, I will definitely be. That's why I am on this quest to understand how to crush this shortage between income and expenses and retire earlier. I will choose to work on my own terms because I am financially free not because I have to.

In my next post, I will share about how you can gather small wealth through savings and middle class wealthy through shares investment.

Sunday 25 June 2017

Let's talk about money

1. How much is enough?

In 2013, Robert and Edward Skidelsy wrote a book "How Much is Enough?" highlighted that most of the people are already blinded by greed and this has already compromised their quality of lives.

2. How will your wealth affect your next generation?

Your wealth will have a direct impact on your life, it will have an effect on your choice on your spouse, senses of happiness and life expectancy. Your wealth will also have an impact on your next generation.

a. Spouse

According to a 2013 survey conducted in China for online dating services, 52% of the man will focus on the looks and 63% of the woman will focus on income level and wealth of the man.

b. Level of Happiness

In 2015, the average GDP of Americans stands at 55,600. Most of the people feels that an annual income of USD 110,000 will be the happiest.

c. Life Expectancy

The rich can afford better medical health treatment than the poor. In 2013, there was a study conducted in 2002 in South Korea, the highest 20% man income level group has an average life expectancy of 77.1 years old whereas the lowest 20% man income level group has an average life expectancy of 67.4 years old. That is a difference of about 9.7 years. The highest 20% woman income level group will be 82.6 years old whereas the lowest 20% woman income level group will be 78.8 years old. There is a small age difference of 3.8 years old.

d. Effect on next generation

If the parents are poor, they won't be able to afford tuition for the children and their results cannot compete with the classmates, affecting their ego and confidence level. Except for a few minority who are self motivated, most of the children from low income family will be faced with disadvantages and challenges.This will create a vicious cycle in poverty.

3. If your money is not enough, what will you do?

a. Part time work

Most of the people will like to make additional income and they tend to trade time for money. There are people who held two jobs to make ends meet. However, as time goes by, it will take a toll on the body and affect the health. In addition, most part time work only pays miserable hourly rate. I do know friends who will drive Grab and Uber to supplement their income.

b. Wealth Management

76% of the wealthy people are the first generation entrepreneurs, investors and top management. The remaining 24% inherited their wealth and they belong to the 2nd or 3rd generation business owners.

In next post, I will touch on how investment will help to shortcut this journey to achieve financial freedom.

In 2013, Robert and Edward Skidelsy wrote a book "How Much is Enough?" highlighted that most of the people are already blinded by greed and this has already compromised their quality of lives.

2. How will your wealth affect your next generation?

Your wealth will have a direct impact on your life, it will have an effect on your choice on your spouse, senses of happiness and life expectancy. Your wealth will also have an impact on your next generation.

a. Spouse

According to a 2013 survey conducted in China for online dating services, 52% of the man will focus on the looks and 63% of the woman will focus on income level and wealth of the man.

b. Level of Happiness

In 2015, the average GDP of Americans stands at 55,600. Most of the people feels that an annual income of USD 110,000 will be the happiest.

c. Life Expectancy

The rich can afford better medical health treatment than the poor. In 2013, there was a study conducted in 2002 in South Korea, the highest 20% man income level group has an average life expectancy of 77.1 years old whereas the lowest 20% man income level group has an average life expectancy of 67.4 years old. That is a difference of about 9.7 years. The highest 20% woman income level group will be 82.6 years old whereas the lowest 20% woman income level group will be 78.8 years old. There is a small age difference of 3.8 years old.

d. Effect on next generation

If the parents are poor, they won't be able to afford tuition for the children and their results cannot compete with the classmates, affecting their ego and confidence level. Except for a few minority who are self motivated, most of the children from low income family will be faced with disadvantages and challenges.This will create a vicious cycle in poverty.

3. If your money is not enough, what will you do?

a. Part time work

Most of the people will like to make additional income and they tend to trade time for money. There are people who held two jobs to make ends meet. However, as time goes by, it will take a toll on the body and affect the health. In addition, most part time work only pays miserable hourly rate. I do know friends who will drive Grab and Uber to supplement their income.

b. Wealth Management

76% of the wealthy people are the first generation entrepreneurs, investors and top management. The remaining 24% inherited their wealth and they belong to the 2nd or 3rd generation business owners.

In next post, I will touch on how investment will help to shortcut this journey to achieve financial freedom.

Thursday 22 June 2017

21st June 2017 - first option trade

On the 21st June 2017, I started with 2 sell puts and collected my first premium. I just read Thumbtackinvestor and I was amazed by his achievements. His options and investing skills are superb. I will look forward to the day when I have a consistent cash flow from options.

The above figure shows a total small premium of about USD 100. I know the premium is not a lot for most people out there but can you imagine USD 100 x 12 months will be USD 1,200!

It also fulfill my key requirement to cover for my monthly course installment fee.

I will work harder to uncover more stocks and use options on them.

Sunday 18 June 2017

VIC Boot Camp 16th - 18th June 2017

I reached Singapore on Thursday 15th June at 10 pm and finally got home around 11pm. By the time I managed to unpack and sleep, it is close to 1 am. The next day I woke up early at 7 am to attend the first day of the boot camp. I joined the VIC boot camp with an initial mindset that I am already a seasoned investor and I just wanted to learn about options. I wanted to learn how to use options to maximise my gains.

I realised that this course is unique and has its strengths. If you want to learn all the fanciful options strategy like vertical, diagonal, etc you will be disappointed. However, this course gives you a very well defined strategy to value a business, access its strength and weakness, conduct valuation and apply sell put or sell call options to further protect your position. It is difficult to lose money using this approach. The course will touch on portfolio management which I never realise is an important investment strategy. I have read everything from "The Five Rules for Successful Stock Investing" by Pat Dorsey and various books on portfolio management but somehow I never piece everything together. This course helps me to align my knowledge, coupled from what I learn in the last 3 days to be a better investor.

I believe there is alot I need to learn and I will continue on this lifelong learning journey to be a better investor. I enjoy learning while progressing towards our quest of financial freedom.

The next few things to do:

1) Fund my Thinkorswim account with real money, start small and test it out

2) Stock screen SG stocks

3) Stock screen HK stocks

4) Stock screen US stocks

Then I will get together with some of my like minded friends and brainstorm on what businesses to acquire.

Never stop learning...

20th June 2017

I transferred USD 4,390 to my Thinkorswim account. Let's start slowly and sell put on 1 contract first.

The money should be in the account either Wednesday or Thursday. Look forward to it!

The new quest is to make USD 120/month in premium to cover my monthly installment for VIC course. Once I can do this consistently for 6 months, then I will attend Ken Teng's OMP course.

13th August 2017

I got greedy in 2nd month and made a lot of mistakes which contravene to the system which I was been taught. I signed up for Ken Teng's OMP course in November.

I realised that this course is unique and has its strengths. If you want to learn all the fanciful options strategy like vertical, diagonal, etc you will be disappointed. However, this course gives you a very well defined strategy to value a business, access its strength and weakness, conduct valuation and apply sell put or sell call options to further protect your position. It is difficult to lose money using this approach. The course will touch on portfolio management which I never realise is an important investment strategy. I have read everything from "The Five Rules for Successful Stock Investing" by Pat Dorsey and various books on portfolio management but somehow I never piece everything together. This course helps me to align my knowledge, coupled from what I learn in the last 3 days to be a better investor.

I believe there is alot I need to learn and I will continue on this lifelong learning journey to be a better investor. I enjoy learning while progressing towards our quest of financial freedom.

The next few things to do:

1) Fund my Thinkorswim account with real money, start small and test it out

2) Stock screen SG stocks

3) Stock screen HK stocks

4) Stock screen US stocks

Then I will get together with some of my like minded friends and brainstorm on what businesses to acquire.

Never stop learning...

20th June 2017

I transferred USD 4,390 to my Thinkorswim account. Let's start slowly and sell put on 1 contract first.

The money should be in the account either Wednesday or Thursday. Look forward to it!

The new quest is to make USD 120/month in premium to cover my monthly installment for VIC course. Once I can do this consistently for 6 months, then I will attend Ken Teng's OMP course.

13th August 2017

I got greedy in 2nd month and made a lot of mistakes which contravene to the system which I was been taught. I signed up for Ken Teng's OMP course in November.

Wednesday 7 June 2017

Enterprise Value

Enterprise Value is a measure of how much you can purchase a company free of its debt and liability. Enterprise Value in Investopedia is defined as the theoretical take over value of the business.

Enterprise Value = Market Cap + (Debt + Minority Interest + Preferred Shares) - Total Cash and Cash Equivalent

Market Capitalisation is the market value of company common shares. It is the current share price x total number of equity shares of company

Debt includes bonds and bank loans, excluding trade creditors. When you take over the business, you will be acquiring its debt as well. Hence, you will need to use the cash to pay down its debt.

Minority Interest is a non-current liability which represents the proportion of the subsidiary owned by minority shareholders.

Cash and Cash Equivalent represents cold hard cash and short term investment which is highly liquid and can be converted into cash. They are subtracted from Enterprise Value because Cash and Cash Equivalent will be used to reduce any outstanding debt level of the business.

How to understand Enterprise Value?

The private equity will completely buy out the targeted company or business, achieved full control of the business. The hostile takeover company will pass all the debt (through funding to acquire company) to the victim company, squeeze out all the cash and asset and use them to pay special dividend (debt financed dividend) for exit strategy.

Enterprise Value = Market Cap + (Debt + Minority Interest + Preferred Shares) - Total Cash and Cash Equivalent

Market Capitalisation is the market value of company common shares. It is the current share price x total number of equity shares of company

Debt includes bonds and bank loans, excluding trade creditors. When you take over the business, you will be acquiring its debt as well. Hence, you will need to use the cash to pay down its debt.

Minority Interest is a non-current liability which represents the proportion of the subsidiary owned by minority shareholders.

Cash and Cash Equivalent represents cold hard cash and short term investment which is highly liquid and can be converted into cash. They are subtracted from Enterprise Value because Cash and Cash Equivalent will be used to reduce any outstanding debt level of the business.

How to understand Enterprise Value?

The private equity will completely buy out the targeted company or business, achieved full control of the business. The hostile takeover company will pass all the debt (through funding to acquire company) to the victim company, squeeze out all the cash and asset and use them to pay special dividend (debt financed dividend) for exit strategy.

Sunday 4 June 2017

04/06/2017 Recent update

Since the day I joined the new company to assist with the bid, I had been working till midnight almost every single day and even on weekend. Last night was the submission date for the first bid, we worked till midnight in the office and successfully submitted it online.

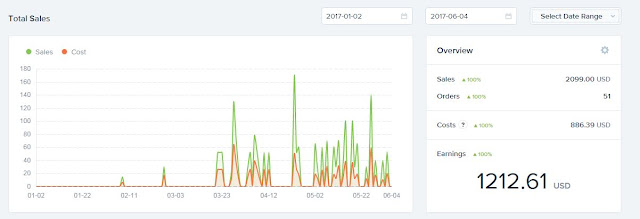

I finally have this afternoon to rest and reflect. I filed all my receipts, mails, and letters. It feels good to unclutter and get everything into my filing system to make things systematic. See below picture for four months of hard work from the team on our ecommerce store (my side business - another source of income). I was not able to contribute much due to my work commitment. I only worked on product fulfillment and customer services. We have not been able to achieve break even stage, the below figure does not include cost on Facebook marketing.

In Mid May, I have cleared the mortgage and close to debt free. See below figure.

I finally have this afternoon to rest and reflect. I filed all my receipts, mails, and letters. It feels good to unclutter and get everything into my filing system to make things systematic. See below picture for four months of hard work from the team on our ecommerce store (my side business - another source of income). I was not able to contribute much due to my work commitment. I only worked on product fulfillment and customer services. We have not been able to achieve break even stage, the below figure does not include cost on Facebook marketing.

|

| Figure 1 - Revenue from ecommerce store |

|

| Figure 2 - Clear our mortgage |

I could have deployed the money to generate higher returns and complete our quest to achieve financial freedom earlier but it was a family decision. Recently I completed reading a classic book "100 to 1 in the stock market", it is a good book and I learnt a lot from it. This has shaped a new investment approach. I am trying to formulate whether I should take a more "income" approach or "growth" approach. If the company gives out dividend instead of retained earnings, it will be slower to grow. You cannot have the cake and eat it. If the company has a lot of cash, achieves low return on equity and does not give out dividend, the shareholders are worst off. In Singapore context, I will prefer the company to give out the dividend as I do not see very brilliant business owners as compared to Thailand, Asia and USA. At this moment, I have 60% of my portfolio in "income" stocks and maybe I should rebalance to position 70% in growth stocks.

Recently, I saw a few posts on a Facebook group discussing a topic on "30 years old and have 100k". I believe everyone is a winner if they are able to achieve financial freedom at 30, 40, 50, 60 or 70 years old. This is your own journey, it is never a competition. I just need to achieve SGD 2 m in my portfolio and I will call it a day. My mentor wants a SGD 10 m milestone. It depends on your lifestyle and ultimately how much do you need. I just want to have the freedom to choose my own lifestyle.

I tabulate JC Fund account and in May the Fund has achieved SGD 920k (cash position) and the fund should be able to cross the SGD 1,000k mark by end of 2017.

Subscribe to:

Posts (Atom)

Latest Post

We have moved!

We have moved to a new website: www.jcprojectfreedom.com Visit us there!

-

We have moved to a new website: www.jcprojectfreedom.com Visit us there!

-

Sector ETFs overpower Individual Stocks Why does the sector pull matter? Stocks are hostage to them, even if individual companies don't...

-

It has been about 2 months since I stopped working. Time passes by very fast. In today's church sermon, it is about time. There is alway...