In March, I spent time on career discovery with Finexis Advisory, Phillips Capital and IPP FA. I sat through a few of the sales training, personality test, financial planning process and team meeting in Finexis Advisory EXO. From all the sessions, I find that EXO has one of the most comprehensive system which will prepare the new financial consultant to succeed in the business. I think EXO has a good team culture, with senior managers having specialized skill sets to complement the team knowledge. I attended one of their investment training which explains the importance of diversification and how Finexis harness their team of researchers' knowledge to advise on investment products. The session helps me to understand that instead of spending so much time on researching stocks to purchase, sometimes you spend some money to engage a specialist to invest and manage on your behalf has its own advantages such as freeing up your time. Definitely it is still your money and you should look closely at the performance of the fund. On the other hand, value investors feel that stock picking is a game, when you are enjoying what you are doing, it is not work.

I believe in my future career, I will have a stint with one of the independent financial advisory.

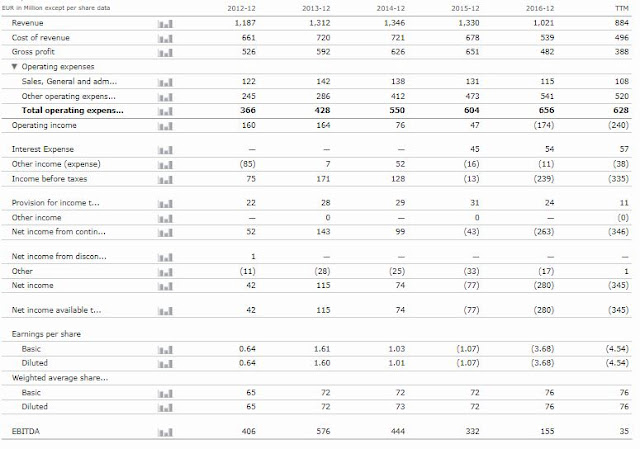

I was offered a new role with an offshore support vessel company. However, the salary was another 20% cut from the previous role. The below is the snapshot of the income statement. I will not comment further but I will do my best to stay as long as possible in the company to put food on the table.

I realized that I was too spoiled on the pay because the industry was experiencing high growth for the last ten years. I was able to command high pay at an age of 27 years old (2009) till 2017. Now the pay has reverted to the mean.

I attended an executive workshop at e2i and I got to know a few friends. Some of them were from the marine industry, one gentleman is looking for work since end of 2016, one gentleman suffered from depression a few years ago and back on track to look for work, one gentleman was retrenched when he was 40 years old in 1999 and has been on various contract work till now. Sometimes when we did not go through tough times, we will never know there are a lot of people out there who are in need of help and they are facing different and unique challenges in their lives too.

I pray that my new friends will be able to find new placements within six months and they can remain healthy and positive in life. Life is not just about financial freedom and money. I thank God for humbling me through the various situations he put me in. Stay authentic and humble to myself.

We have embarked on an journey to achieve financial freedom through our investment portfolio and other streams of income.

Friday 30 March 2018

Sunday 11 March 2018

General reflections on 11/3/2018

It has been about 2 months since I stopped working. Time passes by very fast. In today's church sermon, it is about time. There is always a season for rest, teaching me to learn how to be still. I think I have a different type of rest. I have rest from work, rest from difficult and nasty people, commuting long distances, traveling for business acquisition. For the last two months, I have spent my free time in the National Library, doing my own research, reading, studying and meeting up with friends. I met one of my industry friends in the library using the Regus business lounge. I met my MBA classmates. I met my high school friends. I was able to attend weddings, baby birthday parties, and dinner. More importantly, I was able to spend quality time with my family.

At the same time, I am worried for money every time I took out the wallet and withdraw either the credit card or cash. Why should I be worried? I am financially independent. I should be able to cover my family basic expenses. I do not know why there is this fear. I feel that I need to work. I feel that I need to accomplish something more. I feel that I need to contribute to the household income. I did contribute to the household income, I sold some shares and made some money. I just have this sense of insecurity. I have a lot of "what if" scenarios. What if the market crash and draw down of 50%? What if I don't have sufficient money for retirement because I am spending money and not making more money? I feel that I can provide more for the family.

I have more time to think. Think about my present portfolio and how will the business perform in the future. Some of the businesses worry me. Most of them will be fine. I also have time to think about what I will like to do for another 30-40 years of my working life. I cannot forecast 5 years into the future. I can only plan 1-3 years ahead.

1. I will like to join the wealth management industry

2. I am interested in equities (bottom up approach)

3. I am reading up on the macro business news (top down approach) to appreciate currencies, bonds, commodities, employment and interest rates.

4. I want to serve the mass market. I was never brought up in a rich family, my parents save and scrimped to put food on the table. I save money through giving tuition during army days and working guard duties for people to pay for half of my university tuition fees. I continued to teach tuition from 18 years old all the way till 28 years old. I worked every single semester holidays from store man, QA/QC technician, dress up as an elf to give brochures in Raffles Place, zoo facilitator, etc to make and save money. You get the idea. I am very thrifty and always have been an underdog. I have an achiever mentality and want to prove to my primary school friends and people who undermine my capability that I will strive to be better. I believe the underdogs can win the race too if they believe in themselves and continue to work hard for their goals. I want to help them to increase their financial literacy and financial well beings. Yes, I know the money is made from the wealthy but my heart goes out to the mass market. I derive satisfaction from helping few of my friends to improve on their financial well being through financial planning. I want to reach out to more people to understand their needs and how to improve their life.

5. I want to spend quality time with family

Sometimes I will have this gambling mindset, wondering if I have placed $1 m when Creative share price is at $1.25 and sell it at $10, how will my life be. This mentality is same as what if I strike lottery. Stupid and greedy me.

At the same time, I am worried for money every time I took out the wallet and withdraw either the credit card or cash. Why should I be worried? I am financially independent. I should be able to cover my family basic expenses. I do not know why there is this fear. I feel that I need to work. I feel that I need to accomplish something more. I feel that I need to contribute to the household income. I did contribute to the household income, I sold some shares and made some money. I just have this sense of insecurity. I have a lot of "what if" scenarios. What if the market crash and draw down of 50%? What if I don't have sufficient money for retirement because I am spending money and not making more money? I feel that I can provide more for the family.

I have more time to think. Think about my present portfolio and how will the business perform in the future. Some of the businesses worry me. Most of them will be fine. I also have time to think about what I will like to do for another 30-40 years of my working life. I cannot forecast 5 years into the future. I can only plan 1-3 years ahead.

1. I will like to join the wealth management industry

2. I am interested in equities (bottom up approach)

3. I am reading up on the macro business news (top down approach) to appreciate currencies, bonds, commodities, employment and interest rates.

4. I want to serve the mass market. I was never brought up in a rich family, my parents save and scrimped to put food on the table. I save money through giving tuition during army days and working guard duties for people to pay for half of my university tuition fees. I continued to teach tuition from 18 years old all the way till 28 years old. I worked every single semester holidays from store man, QA/QC technician, dress up as an elf to give brochures in Raffles Place, zoo facilitator, etc to make and save money. You get the idea. I am very thrifty and always have been an underdog. I have an achiever mentality and want to prove to my primary school friends and people who undermine my capability that I will strive to be better. I believe the underdogs can win the race too if they believe in themselves and continue to work hard for their goals. I want to help them to increase their financial literacy and financial well beings. Yes, I know the money is made from the wealthy but my heart goes out to the mass market. I derive satisfaction from helping few of my friends to improve on their financial well being through financial planning. I want to reach out to more people to understand their needs and how to improve their life.

5. I want to spend quality time with family

Sometimes I will have this gambling mindset, wondering if I have placed $1 m when Creative share price is at $1.25 and sell it at $10, how will my life be. This mentality is same as what if I strike lottery. Stupid and greedy me.

Friday 9 March 2018

Early Retirement vs Semi-Retirement

Early Retirement

A study conducted by Melbourne University shows that after working for intense long hours will cause brain damage. For workers age 40 years old and above, the ideal number of working days should be just 3 days per week. This will keep the brain active yet will not over exert oneself due to undue stresses.

Seriously, who does not want to work just 3 days a week? I always believe in there is a price to everything. If you work for 3 days a week, I will think this is considered a form of part time work or sharing of work. Part time work can be considered as a subset of semi-retirement. Be it semi-retirement or early retirement, you need to be financially and psychologically prepared. Before you think about early retirement, you need to envisage what sort of lifestyle you want to live when you are retired. With this in mind, then you can work backwards to decide what is to be done to get you there.

Step 1 - Set your retirement goals. When will you like to retire? At what age, will you like to retire? How long will you be retired for? During your retirement, what sort of monthly income or draw down from savings will be required?

Step 2 - You need to work out your personal balance sheet to understand your personal assets and personal liabilities. You can also make use of CPF retirement calculator or some of the online retirement calculator tools to make some simplify forecast and estimation. You can also determine the differences to make up for in order to achieve your retirement goal.

Step 3 - If there is no gap to fill, congratulations, you are well prepared for retirement. If not, proceed to Step 4.

Step 4 - You may want to increase your time frame for wealth accumulation, delaying your retirement age.

Step 5 - You may want to reduce your post retirement monthly income or draw down amount per month.

Step 6 - Reduce your present monthly expenses to increase your monthly savings.

Step 7 - Increase the rate of return of your investment. Remember higher return comes with higher risk.

Most of the people feels that to retire is to stop all forms of work, they will depend on their passive income to maintain their lifestyle to enjoy the finer things in life. If your definition of early retirement is to lead a more prudent lifestyle, reducing your expenses which is more practical and sustainable.

Semi-Retirement

Most of us in their mid-life will strive to have work life balance to have more quality time with the family. I am sure you too will like to have early retirement. The age group between 40 - 50 years old will be commanding the highest income level during their working lifetime. However, this is the age group where their family expenses will be highest as well due to children education, ageing parents and home mortgages.

If you will like to maintain a certain level of lifestyle and your savings cannot last for the entire duration, you can consider another form of retirement. You can find a part time job to keep yourself active while maintaining your lifestyle.

Many Singaporeans are over dependent on their CPF as the main source of retirement fund. However, you can only draw down after an age of 65 years old. If you wish to retire before 65 years old, then you need to have other source of income.

For early retirement and semi-retirement, the expense will be at a similar level compared to your working days. Early retirement is to enjoy the same level of lifestyle, usually people will not reduce their expenses. In the worse case scenario, it will be even higher than before.

In order to retire earlier, you need to do the following:

1) Be very thrifty

2) Invest alot

When it comes to investment, do not have a gambling mentality in order to make money in the shortest time, thinking this will allow you to retire earlier. What if you are wrong? This will set you back in terms of your retirement fund and retirement age.

If you are 40 years old this year and will like to retire at 55 years old, you have 15 years to save and invest to lead the retirement life you desire. If you have already accumulated sufficient CPF, you can consider contributing to your CPF voluntarily to earn a higher interest and reduce your taxes.

3 Tips towards Semi-Retirement

1) Ensure that you have sufficient savings to cater for retired lifestyle. A part time job will have lesser income than your full time job. You can depend on your part time job to save up on your retirement fund.

2) Part time employee may not have health and medical benefit, you need to ensure that you have sufficient health and medical insurances. A drastic medical event may wipe out your retirement fund if you are adequately covered by insurance.

3) Part time income may not be stable and as high as full time employment. Therefore you need to change your spending habits. For example, cook your own meals or eat mixed vegetables rice instead of going to posh restaurants.

A study conducted by Melbourne University shows that after working for intense long hours will cause brain damage. For workers age 40 years old and above, the ideal number of working days should be just 3 days per week. This will keep the brain active yet will not over exert oneself due to undue stresses.

Seriously, who does not want to work just 3 days a week? I always believe in there is a price to everything. If you work for 3 days a week, I will think this is considered a form of part time work or sharing of work. Part time work can be considered as a subset of semi-retirement. Be it semi-retirement or early retirement, you need to be financially and psychologically prepared. Before you think about early retirement, you need to envisage what sort of lifestyle you want to live when you are retired. With this in mind, then you can work backwards to decide what is to be done to get you there.

Step 1 - Set your retirement goals. When will you like to retire? At what age, will you like to retire? How long will you be retired for? During your retirement, what sort of monthly income or draw down from savings will be required?

Step 2 - You need to work out your personal balance sheet to understand your personal assets and personal liabilities. You can also make use of CPF retirement calculator or some of the online retirement calculator tools to make some simplify forecast and estimation. You can also determine the differences to make up for in order to achieve your retirement goal.

Step 3 - If there is no gap to fill, congratulations, you are well prepared for retirement. If not, proceed to Step 4.

Step 4 - You may want to increase your time frame for wealth accumulation, delaying your retirement age.

Step 5 - You may want to reduce your post retirement monthly income or draw down amount per month.

Step 6 - Reduce your present monthly expenses to increase your monthly savings.

Step 7 - Increase the rate of return of your investment. Remember higher return comes with higher risk.

Most of the people feels that to retire is to stop all forms of work, they will depend on their passive income to maintain their lifestyle to enjoy the finer things in life. If your definition of early retirement is to lead a more prudent lifestyle, reducing your expenses which is more practical and sustainable.

Semi-Retirement

Most of us in their mid-life will strive to have work life balance to have more quality time with the family. I am sure you too will like to have early retirement. The age group between 40 - 50 years old will be commanding the highest income level during their working lifetime. However, this is the age group where their family expenses will be highest as well due to children education, ageing parents and home mortgages.

If you will like to maintain a certain level of lifestyle and your savings cannot last for the entire duration, you can consider another form of retirement. You can find a part time job to keep yourself active while maintaining your lifestyle.

Many Singaporeans are over dependent on their CPF as the main source of retirement fund. However, you can only draw down after an age of 65 years old. If you wish to retire before 65 years old, then you need to have other source of income.

For early retirement and semi-retirement, the expense will be at a similar level compared to your working days. Early retirement is to enjoy the same level of lifestyle, usually people will not reduce their expenses. In the worse case scenario, it will be even higher than before.

In order to retire earlier, you need to do the following:

1) Be very thrifty

2) Invest alot

When it comes to investment, do not have a gambling mentality in order to make money in the shortest time, thinking this will allow you to retire earlier. What if you are wrong? This will set you back in terms of your retirement fund and retirement age.

If you are 40 years old this year and will like to retire at 55 years old, you have 15 years to save and invest to lead the retirement life you desire. If you have already accumulated sufficient CPF, you can consider contributing to your CPF voluntarily to earn a higher interest and reduce your taxes.

3 Tips towards Semi-Retirement

1) Ensure that you have sufficient savings to cater for retired lifestyle. A part time job will have lesser income than your full time job. You can depend on your part time job to save up on your retirement fund.

2) Part time employee may not have health and medical benefit, you need to ensure that you have sufficient health and medical insurances. A drastic medical event may wipe out your retirement fund if you are adequately covered by insurance.

3) Part time income may not be stable and as high as full time employment. Therefore you need to change your spending habits. For example, cook your own meals or eat mixed vegetables rice instead of going to posh restaurants.

Subscribe to:

Posts (Atom)

Latest Post

We have moved!

We have moved to a new website: www.jcprojectfreedom.com Visit us there!

-

We have moved to a new website: www.jcprojectfreedom.com Visit us there!

-

Sector ETFs overpower Individual Stocks Why does the sector pull matter? Stocks are hostage to them, even if individual companies don't...

-

It has been about 2 months since I stopped working. Time passes by very fast. In today's church sermon, it is about time. There is alway...