What should an investor do when all asset classes appear overpriced? The 10-year US treasury Bond yields about 2.6% which is much lower than the 5% historical average and only slightly higher than the Federal Reserve's 2% inflation rate target. S&P 500 Index has recorded new all-time highs, Hang Seng Index was at a new record high in January 2018 and even laggard Straits Times Index is close to all time high of 3800.

The cycle adjusted price/earnings ratio (CAPE) - the valuation metric which predicts future 10 year rate of return is about 34. That's one of the highest valuation exceeding only readings in 1929 and early 2000, prior to crashes. Today's CAPE suggests that 10 year equity rate of return will be barely positive. Do you believe that this time it will be different?

A corollary is that no one can consistently time the market. Proper market timing involves making two decisions - when to get out and when to get back in. Timing both correctly is virtually impossible. Investors who try to outsmart the market more often get it wrong than right.

What can an investor do to minimize this risk? Here are some options:

Rebalance

A simple portfolio that started out 2009 with 60 percent in US stocks and 40 percent in US bonds would now have close to 80 percent in stocks and 20 percent in bonds. You can rebalance and set target asset allocation weights and periodically rebalance back to your preset amounts on occasion.

Overbalance

If you are worried about stocks, you can shift money to underperforming assets. Value stocks have underperformed growth stocks by more than 3 percentage points annually over the last decade. US stocks have outperformed International stocks which include European stocks and emerging markets over the same intervals. Hence, investors looking at mean reversion could allocate more of their portfolios to value and international stocks.

Avoid complexity and shift to Cash/Bonds

There are plenty of complex hedging techniques available but require incredible foresight to work. It is difficult to time the trades, volatility and costs can eat into your returns. The easiest way is to simply take less risk by raising more cash or invest in high quality bonds and lesser equities. By holding enough cash on hand will give you the peace of mind in knowing you can meet your expenses in a downturn is worth more than a few percentage points in returns. This money is your war chest which you can use in the next round of downturn.

Buy and Hold

Being a long term investor is easy when the market price is going up but when it is coming down, it is a test of grit and temperament. Beside been emotionally challenging, it is a great way to avoid transaction cost and market timing errors.

Use momentum

Momentum is based on the idea that asset that performs well will continue to perform well and vice versa for a short period of time because market is irrational in the short run.

Diversification

Staying the course in a broadly diversified portfolio is the best strategy when all asset classes appear overpriced. If rebalancing is required to constrain portfolio risk, consider good quality dividend stocks. With a yield of about 5%, it offers some return even when the market turns against you.

Each of these approaches has its own drawbacks and limitations. The best investment strategy is one which will suit your temperament and you stick to it.

We have embarked on an journey to achieve financial freedom through our investment portfolio and other streams of income.

Sunday, 28 January 2018

Saturday, 27 January 2018

Self-justification on why I shift out from IEF and TLT

Why I cut loss on Treasuries ETF?

In my earlier post, I shared that I cut losses on all my LEAP calls on IEF ETF and TLT ETF. I have read previously on the perfect (all weather) 60-40 equity bond portfolio which beat both holding 10 year Treasury and reinvesting coupons returned 155% and S&P 500 with dividends 158%. The theory is when stocks are up, you need to rebalance and shift to bonds, vice versa. The crux lies in the link between equity and bond, when there is a crisis, investors will flee to Treasury which is considered as a safe haven.

The risk is that bond yields rise without any corresponding strength in economy to protect the profits and stock prices. This may be caused by Inflation and Interest Rates hike. Allow me to side track my previous train of thought on this, if the corporate taxes are reduced, the deficit in the long run will increase, the Interest Rate will not increase as fast as Federal Reserve will like to.

Behavior of Shares and Bonds

Prices of Shares and Bonds have moved in opposite direction since the 1990s with a strong negative correlation. Since the start of 19th century, there has been only one other significant period where stocks and bonds behaved this way according to Ian Harnett of Absolute Strategy Approach. The late 1950 and 1960s had a similar stock bond relationship to the past few years. The behavior of share and bond prices moving inversely may change, but question is when will this shift materialize?

The extra yield on Treasury investors are looking for to compensate for inflation uncertainty is extremely low. The other risk is Fed, quantitative easing has only just been put into reverse mode, the 4 trillion is only 3 billion smaller. As the balance sheet shrinks, the pressure is put on bond yields and downward pressure on stock prices. I believe inflation will be low for 2018, economy will improve further but higher bond yield will definitely happen.

Bond Bear Market

Legendary value investor Bill Miller has an optimistic view on equity market. He strongly believes that bond bull market has come to an end and investors are cashing out from bond market, shifting to equity market. He said,"I believe that if rates rise in 2018, taking the 10 year treasury above 3 percent, that will propel stocks significantly higher, as money exits bond funds for only the second year in the past ten. Bonds, in my opinion, have entered a bear market, but one that is likely to be benign for the next year or so."

The market had already showed a strong rally in 2017 and a strong start in 2018. The improvement in corporate earnings, global recovery, tax reform, improvement in fundamental factors and further stimulus to economy drove the market prices up. According to Bill Miller, investors are shifting from bond market to stocks which will further reinforce the stock price's movement. My guess is rising bond yield condition will further depress bond prices (TLT and IEF). The thesis is the bull run for bond market may come to an end.

Warren Buffet felt that stocks have gotten less attractive but they are still very highly attractive compared to bonds because interest rates are very low. With rising valuations, it is not like buying shares after the 2008 financial crisis which is like shooting fish in a barrel. Nonetheless, I felt that rather than seating and waiting for the Treasury ETFs to appreciate, it will be better to switch out to stocks and ride this last wave.

In my earlier post, I shared that I cut losses on all my LEAP calls on IEF ETF and TLT ETF. I have read previously on the perfect (all weather) 60-40 equity bond portfolio which beat both holding 10 year Treasury and reinvesting coupons returned 155% and S&P 500 with dividends 158%. The theory is when stocks are up, you need to rebalance and shift to bonds, vice versa. The crux lies in the link between equity and bond, when there is a crisis, investors will flee to Treasury which is considered as a safe haven.

The risk is that bond yields rise without any corresponding strength in economy to protect the profits and stock prices. This may be caused by Inflation and Interest Rates hike. Allow me to side track my previous train of thought on this, if the corporate taxes are reduced, the deficit in the long run will increase, the Interest Rate will not increase as fast as Federal Reserve will like to.

Behavior of Shares and Bonds

Prices of Shares and Bonds have moved in opposite direction since the 1990s with a strong negative correlation. Since the start of 19th century, there has been only one other significant period where stocks and bonds behaved this way according to Ian Harnett of Absolute Strategy Approach. The late 1950 and 1960s had a similar stock bond relationship to the past few years. The behavior of share and bond prices moving inversely may change, but question is when will this shift materialize?

|

| Relationship between S&P and IEF 7 years Treasury ETF |

|

| Relationship between S&P and SHY 3 years Treasury ETF |

The extra yield on Treasury investors are looking for to compensate for inflation uncertainty is extremely low. The other risk is Fed, quantitative easing has only just been put into reverse mode, the 4 trillion is only 3 billion smaller. As the balance sheet shrinks, the pressure is put on bond yields and downward pressure on stock prices. I believe inflation will be low for 2018, economy will improve further but higher bond yield will definitely happen.

Bond Bear Market

Legendary value investor Bill Miller has an optimistic view on equity market. He strongly believes that bond bull market has come to an end and investors are cashing out from bond market, shifting to equity market. He said,"I believe that if rates rise in 2018, taking the 10 year treasury above 3 percent, that will propel stocks significantly higher, as money exits bond funds for only the second year in the past ten. Bonds, in my opinion, have entered a bear market, but one that is likely to be benign for the next year or so."

The market had already showed a strong rally in 2017 and a strong start in 2018. The improvement in corporate earnings, global recovery, tax reform, improvement in fundamental factors and further stimulus to economy drove the market prices up. According to Bill Miller, investors are shifting from bond market to stocks which will further reinforce the stock price's movement. My guess is rising bond yield condition will further depress bond prices (TLT and IEF). The thesis is the bull run for bond market may come to an end.

Warren Buffet felt that stocks have gotten less attractive but they are still very highly attractive compared to bonds because interest rates are very low. With rising valuations, it is not like buying shares after the 2008 financial crisis which is like shooting fish in a barrel. Nonetheless, I felt that rather than seating and waiting for the Treasury ETFs to appreciate, it will be better to switch out to stocks and ride this last wave.

JC Options Fund Update 27 Jan 2018

Just now, I experience a moment of fear. I remember recently in 2017, I experienced a fearful incident. I took the staircase in International Plaza on the 26th floor to 25th floor then I tried to open the door but it was locked from inside. I started to descend to the next level and try to open the door. Again it was locked. Then I tried the next floor and the next one. Fear started to creep in when I went to 20th floor. I was flustered and worried what if nobody realized that I am missing as it was a Sunday. Then I calm myself, took a breather and continue to walk downstairs and finally the door was able to open on the 6th floor which leads to the car park.

My fear earlier was when I did a cut loss on all my TLT and IEF options. It was very painful and scary. I just frantically pressed the right click button on the mouse and execute the close position order. I will explain my rationale why I need to shift out from bonds in another post. For capital loss, it was - USD 4,304.95 and premium loss was - USD 433.88. OUCH! To justify for the losses, I chased after a volatile stock AAPL and sell put on it to gain the premium of USD 9,189.54. I think it is going to be shitty as 1st February after market close, the earnings is going to be released. Yes, I did not check the earnings date again. This is the type of situation which you can only pray that the earnings is good and you get to keep the differences and free up your capital. Worst case scenario, it is going to be a thick white bar downwards like the month of November 2017 as shown in the above figure. If it happens, the thick white bar is going to be very scary.

Thursday, 25 January 2018

Evolution from a Trader to Investor

I borrowed a book called "Evolution of a Trader - Fundamental Analysis and Position Trading" from the library. I think the concept of the book is interesting as it talks about fundamental analysis and how you can enhance your gain by swing trading. I recalled just a few days ago I met up with my trusted financial advisor. He recalled that about 4 years ago, he started to share with me about value investing. He introduced to me Fifth Person's online course. I recalled my mentor that he is a value investor and not a good trader. He mentioned to me that trading will not be as profitable as value investing. I agreed that my wealth did not grow much during my earlier years trading in stocks. The following, I will like to discuss the differences between trading and investing.

Capital

Day trading or short term trading needs to have a certain amount of capital to make it sustainable for income. In addition, you need to cater for the commission and taxes for entering and exiting the trades. If the capital is not big enough, after deducting all the commissioning and taxes, it will hardly cover your profit. I tried this in 2008 for an entire month of day trading as I was on my garden leave. I made about SGD 3k but it was very stressful and you need to be fast to react to the few ticker movements to make a profit.

Time

Day trading will require time commitment. You need to be in front of the screen, fully concentrated to look at the charts, 1 year chart, 1 day chart, 15 mins chart and 1 min chart. Most of the actions will happen in the first two hours when the market opens and 1 hour before the market closes.

Investing can be done anything because the research work can be conducted anytime. I will say probably spend 1-2 hours a day to research on your present portfolio and those in your watch list. Then you just need to follow up on the quarterly results to review the companies. This is more suitable for most working population.

Discipline and Patience

Both trading and investing will require discipline and patience. Day/short term trading will involve more active price involvement, looking for the right setup and trigger point. Investing involves waiting for the right swing and give it your best shot. It means you need to wait for opportunity to acquire the business when there is a mispricing. This mispricing is a short window and will be gone when everyone starts to realise it. Both trading and investing require risk management. Both will require to understand what is the value at risk and the potential return, whether this return justifies the risk.

Return

Speaking of return, I will mention that day or short term trading can generate high return fast, compounding on daily or short term basis will grow the amount. However, once a trader makes a mistake or a series of mistakes, it will wipe out all the gains. For wealth accumulation, I will suggest to take the route of investing, taking a longer time frame to compound and grow the money.

Conclusion

In conclusion, investing is recommended to build your retirement sum, reinvestment of dividend and new capital will help to speed up the compounding effect. Trading is meant for income and you need to spend time on it.

Capital

Day trading or short term trading needs to have a certain amount of capital to make it sustainable for income. In addition, you need to cater for the commission and taxes for entering and exiting the trades. If the capital is not big enough, after deducting all the commissioning and taxes, it will hardly cover your profit. I tried this in 2008 for an entire month of day trading as I was on my garden leave. I made about SGD 3k but it was very stressful and you need to be fast to react to the few ticker movements to make a profit.

Time

Day trading will require time commitment. You need to be in front of the screen, fully concentrated to look at the charts, 1 year chart, 1 day chart, 15 mins chart and 1 min chart. Most of the actions will happen in the first two hours when the market opens and 1 hour before the market closes.

Investing can be done anything because the research work can be conducted anytime. I will say probably spend 1-2 hours a day to research on your present portfolio and those in your watch list. Then you just need to follow up on the quarterly results to review the companies. This is more suitable for most working population.

Discipline and Patience

Both trading and investing will require discipline and patience. Day/short term trading will involve more active price involvement, looking for the right setup and trigger point. Investing involves waiting for the right swing and give it your best shot. It means you need to wait for opportunity to acquire the business when there is a mispricing. This mispricing is a short window and will be gone when everyone starts to realise it. Both trading and investing require risk management. Both will require to understand what is the value at risk and the potential return, whether this return justifies the risk.

Return

Speaking of return, I will mention that day or short term trading can generate high return fast, compounding on daily or short term basis will grow the amount. However, once a trader makes a mistake or a series of mistakes, it will wipe out all the gains. For wealth accumulation, I will suggest to take the route of investing, taking a longer time frame to compound and grow the money.

Conclusion

In conclusion, investing is recommended to build your retirement sum, reinvestment of dividend and new capital will help to speed up the compounding effect. Trading is meant for income and you need to spend time on it.

Sunday, 21 January 2018

Hedging with Options

Hedging enables the fund manager to transfer part of the risk with holding a position in the underlying instrument from one party to another. Options act like an insurance policy. There is a cost with hedging. It involves initial cash or opportunity costs involved such as potential profits and additional risk exposure in certain scenario.

Using Options to Protect an Equity Portfolio

Buying protective puts is the most obvious way to hedge a portfolio. The investor selects the option with a specific expiry date and strike price, the level of risk assumed and the cost (premium paid) incurred is known.

Selling Covered Call is selling options against long position. This strategy does not offer limited downside risk compared to buying protective puts. Income (premium) generated from selling call options can mitigate a decline in the portfolio value, but the premium received may not provide much buffer when the stock/underlying asset's price falls sharply in the market. I have limited my gains when I previously sold call on SKX at $26, when the results came out, the price went up to $30 and as of 21st Jan 18, it is about $39. Selling Call can limit your upside and provide limited downside. If the stock price is neutral and does not move much, it can enhance your yield or premium can be considered as an income.

Zero-Cost Options

If an investor wants to hedge with very limited risk exposure, he can do so by simply purchasing an option. If he also wants to avoid putting up cash associated with such a strategy, he can achieve this by been cash neutral through simultaneously combining the purchase of the option with a sale of another option.

This is known as a zero-cost dollar, by buying protective put and writing an out of money covered call. The call option is sold with a strike price where the premium received is equal to the premium paid to buy the put. This zero dollar collar is used to protect existing long stock positions with little or no cost.

Using Options to Protect an Equity Portfolio

Buying protective puts is the most obvious way to hedge a portfolio. The investor selects the option with a specific expiry date and strike price, the level of risk assumed and the cost (premium paid) incurred is known.

Selling Covered Call is selling options against long position. This strategy does not offer limited downside risk compared to buying protective puts. Income (premium) generated from selling call options can mitigate a decline in the portfolio value, but the premium received may not provide much buffer when the stock/underlying asset's price falls sharply in the market. I have limited my gains when I previously sold call on SKX at $26, when the results came out, the price went up to $30 and as of 21st Jan 18, it is about $39. Selling Call can limit your upside and provide limited downside. If the stock price is neutral and does not move much, it can enhance your yield or premium can be considered as an income.

Zero-Cost Options

If an investor wants to hedge with very limited risk exposure, he can do so by simply purchasing an option. If he also wants to avoid putting up cash associated with such a strategy, he can achieve this by been cash neutral through simultaneously combining the purchase of the option with a sale of another option.

This is known as a zero-cost dollar, by buying protective put and writing an out of money covered call. The call option is sold with a strike price where the premium received is equal to the premium paid to buy the put. This zero dollar collar is used to protect existing long stock positions with little or no cost.

Friday, 19 January 2018

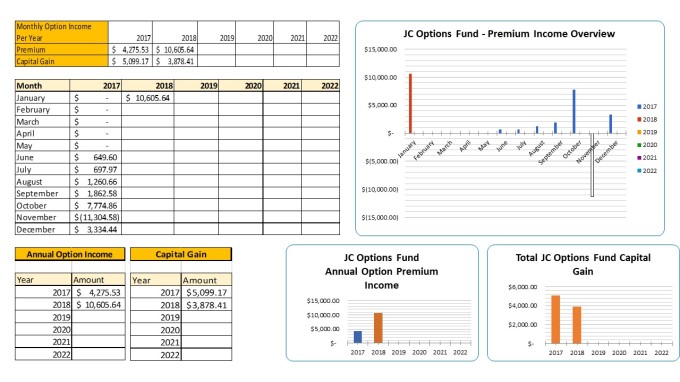

JC Options Fund - January 2018 Update

I have divided the tabulations into two sections for JC Options Fund, the first leg will be Annual Options Income and the second leg will be from Capital Gain. For January 2018, I have used Diagonal Call on three counters to achieve the capital gain. For the monthly options premium, I have achieved USD 1,865 which is approximately 3% yield per month based on my initial injected capital into JC Options Fund.

I have taken a large position in TLT ETF both in terms of Diagonal Call and sell put. My take is for 2018, the yield should not increase fast enough and there is still some room for the price to appreciate. I am trying to use GLD and TLT to smooth the deviation of the entire portfolio's performance.

|

| Figure 1 - JC Options Fund Overview and Performance |

Overall, I am still experimenting with how options can be used to enhance yield and hedge against existing positions in JC Fund. When I hedge an existing position by buying an insurance through buy put, I will be reducing my overall performance.

I have tried another strategy which is selling put on a counter, with the premium gain, I will use it to do a buy LEAP call on GLD or TLT.

Wednesday, 17 January 2018

17/1/2018 Interesting Encounters

This morning I sat outside Starbucks and I was about to start my revision on CMFAS M6A when a guy called out to me. He used to be my assistant project engineer a decade ago.

I think he is a messenger sent from God.

He told me he left the last company two years ago and has been self employed since. He has been driving Uber. It is easy to break even but to be profitable is not as easy as it seems. There is a lot of strategic planning with route, fuel efficiency and where the passengers are to increase the hit rate of getting a customer. He told me a lot of his friends who are driving Uber dropped out because there is no CPF contribution. Getting a job with CPF seems like a better choice for them. I agree that CPF contribution compounded over the long run can be an astonishing amount.

He explained further he will drive Uber in the morning till 10am, he will proceed to warehouse to pick up goods and use the rental car to make delivery. Then he will go back to rest from 2-4pm before driving the evening shift. In addition, he has an event management business. He explained that you need to have a few businesses or streams of income to see which works better. This year, he is 35 years old and he set a deadline by 38 years old he needs to make it in business, if not he will go back to get a job.

I went to the library and queue up at 10 am to enter. All the staff came out to greet us to start the day, it was a good feeling and I felt like a super star. Haha. In addition, I found a nice spot in the library with a nice view.

While studying these two days in the library, I saw a middle aged man dressed up formally using his laptop. He is actively sending his resume and apply for jobs. I was thinking does his family knows that he is out of job and he still dress like he is working and goes out everyday. Maybe tomorrow I will reach out to him and talk to him. Sometimes, he will check the status of his stock holdings. Maybe I will use that as a conversation starter.

Today I clear all the trust fund and acquire more HK shares.

Tuesday, 16 January 2018

15/1/2018 - First Day of Liberation

I woke up at 7.30 am. I brought my son to the doctors in the morning, had lunch at about 11.30 am. Then I went to study for my M6A exam.

I save 1.5 hours to travel to my previous work place. I save another 1.5 hours to travel back to home. In total, I save 3 hours commuting to work. I have worked in the Eastern side of Singapore since 2009. Assuming all the time I was in Singapore and I used public transportation for calculation purpose.

9 years -> 22 days/ month x 12 months x 9 years = 2,376 days

2,376 days x 3 hours = 7,128 hours on commuting which is equivalent close to 1 year.

I have spent numerous hours waiting at the airport, transiting, traveling on taxi, stuck in traffic jams.

1) I get to save time on commuting and create 3 more hours to spend time with my love ones, pursue my interest, read more books and financial reports.

2) I feel a strong sense of urgency to make money and motivated. An urgency to make money. I am self-employed, what I make everyday will determine the pay cheque at the end of the month. If I am a business owner, my daily revenue will determine the month end revenue. This is different compared to when I was working for someone, I always feel end of the month comes very slowly and always wonder when the pay cheque will come. However, I feel that now everyday passes very fast.

3) I feel that my brain starts to work. I start to think of all the possible ways to make things possible.

This afternoon, I continue to buy more HK stocks. Recently, I went on a buying spree, rebalance some of the stocks which I have held for 2-3 years.

I save 1.5 hours to travel to my previous work place. I save another 1.5 hours to travel back to home. In total, I save 3 hours commuting to work. I have worked in the Eastern side of Singapore since 2009. Assuming all the time I was in Singapore and I used public transportation for calculation purpose.

9 years -> 22 days/ month x 12 months x 9 years = 2,376 days

2,376 days x 3 hours = 7,128 hours on commuting which is equivalent close to 1 year.

I have spent numerous hours waiting at the airport, transiting, traveling on taxi, stuck in traffic jams.

1) I get to save time on commuting and create 3 more hours to spend time with my love ones, pursue my interest, read more books and financial reports.

2) I feel a strong sense of urgency to make money and motivated. An urgency to make money. I am self-employed, what I make everyday will determine the pay cheque at the end of the month. If I am a business owner, my daily revenue will determine the month end revenue. This is different compared to when I was working for someone, I always feel end of the month comes very slowly and always wonder when the pay cheque will come. However, I feel that now everyday passes very fast.

3) I feel that my brain starts to work. I start to think of all the possible ways to make things possible.

This afternoon, I continue to buy more HK stocks. Recently, I went on a buying spree, rebalance some of the stocks which I have held for 2-3 years.

Friday, 12 January 2018

Close of a chapter

10/1/2018

I understand where my managing director (friend) is coming from, he must be thinking that when previous company closes the Singapore office in April 2017, he gave me this opportunity to join them. I was hired to tender for a major project which if the company wins it, will guarantee them 20-30 years of cashflow.

In addition, I started work one week prior to joining them to prepare for the tender documents and I was not calculative to charge them for this one week. When I joined them, they fail to fulfill the part on the transport allowance which is SGD 1,000 per month. When we traveled and worked on the weekend, I was not calculative that they need to compensate me off in lieu or compensate me for my annual leave. I remember for the first three months while preparing the tender, I was working every weekends for the entire duration.

I am not going to ask for full compensation (3 months notice pay + 12 days of annual leave) as the company doesn’t have the cash. However they cannot just leave me in lurch and just ask me to go without any pay. All I wanted is a soft landing. The chairman chooses to terminate me before Christmas is a horrible man, spoiling my holidays season.

To add, if they have won the project, I will not share the upside but there should not be any downside on my part. If they cannot honor a 3 months notice period, they should amend the contract in the first place.

Definitely, there are instances on my part that I fail to deliver. There are days which I just bum around and try to act busy when there is not much work. I am just ranting about the negative side of the story.

11/1/2018

When I spoke to the chairman, the initial conversation goes like this," You can stay on to do your own things, we will take back the laptop and you can sit here for the next 3 months. The company will pay you. If the company cannot pay you, you can sue the company. However, you must take note that I am one of the directors here, I do not owe you anything, it is the company which will owe you." I know the company law and how a private limited company works.

I negotiated a deal with the chairman to compensate me just a full month salary excluding the annual leave and allow me to leave immediately. We got into a quarrel at first but after understanding that this is a good deal for both parties, everyone cool down and close it amicably. For him, it helps the company to save 2+ months of salary cost and I will get my pay upfront to avoid unnecessary stress and disappointment at a later stage if they decide to close the company. A bird in hand is better than the bird in the tree.

He bought me to lunch which was a Nasi Bryani and divided it into two portion. He finished his and started to eat into mine.

He bought me to lunch which was a Nasi Bryani and divided it into two portion. He finished his and started to eat into mine.

12/1/2018

I got my cheque for one month salary. Chapter closed and time to move on. I am officially a free man and there will not be another pay cheque coming in anymore at the end of every month. It is a scary feeling but what the heck! I hope I will not panic, just focus and take one shot at a time.

Lessons learnt after this incident:

1. Always check the paid up capital and cash flow of the company. No cash flow means sooner or later the employees have to leave.

2. It is not advantageous for an employee to sue a company with small paid up capital

3. If you have observed that other colleagues/personnel are not paid, this is a red flag that this will happen to you one day

4. Remember if someone bad mouth of others in front of you, they will do the same about you to others. If they do not pay others, they will not pay you as well. There will be consistency.

5. Always try to put yourself in others' shoes and understand what they want. Then it will be easier to get what you want.

6. Sometimes you need to give in to get (or cut your losses).

7. Learn to let go.

8. You reap what you sow.

9. Always be compassionate to others.

10. This too shall pass. In another year, this incident will not affect me anymore but I hope I have grown wiser in reading people.

Pray that my cheque won't bounce.

Tuesday, 9 January 2018

A series of unhappy events at work

4/1/2018

At the start of the new year, I am counting down to the day when I leave the company. The chairman who is my Managing Director's Uncle tried to use a scare tactic on me yesterday. He told me that my situation is kind of embarrassing. I am considered the new "middle age" group.

1) A new industry will not want to hire me as it involves training and by the time I am competent, i will be around 40 years old. I can only work for another 10 years in the company or industry.

2) There are a lot of very experienced 40+ years old candidates out there.

3) On the other extreme, the young fresh graduates commands a lower pay, they are more energetic and filled with drive.

Therefore he told me either I cut my pay by half or I start my own business.

5/1/2018

Today, it took a drastic change, the chairman told me that he doesn’t have any money to pay me for my three months notice period and ask me to leave immediately in order not to waste my time. Even if I wait on till the end of the money, he told me the money will not come.

I checked with other friends who used to work there previously. Similar situation happens to them as well. One of them told me that he was not paid for the last three months and everyday he turn up at work begging them to pay him the salary. He suffered in 2016, the family did not enjoy the Christmas and Chinese New Year.

I cannot understand why an employer can just drop you if they do not have any need for you anymore and declare that "I do not need to fulfill my part of the contract and do not need to pay your notice period".

9/1/2018

I am feeling more settled down and I have called MOM. I spoke to a lady called Pamela who is not the best customer service representative. All her questions were targeted to understand whether you are a PMET or not. I just have to wait till the end of the month.

In short, our government is pro-SME and businesses. They will take care of employees with lesser than SGD 4,500, which are covered under the employment act. However, if your pay is more than SGD 4,500 and you are a PMET, you need to take care of your own self.

I concluded it is never going to be easy for the middle class population. Yes, you may have higher than average pay but you will be the first to go when the company wants to cut cost. You will be taxed the highest which is fair. You will not get to enjoy all the government subsidies, buy BTO, etc. All these I understand and it is a fair system.

All in all, this strengthens my belief that I need to move into self employment or business.

Internally I am not used to not receiving a pay check at the end of the month. Never in my decade long of employment, I have a single break with no salary coming in. I have pride myself for able to have full employment one job after another. I did reach out to industry friends to ask for jobs.

There is another stress factor when my wife told me that her work may further be outsourced. We are all vulnerable. Worst case scenario is for both of us to go out of jobs at the same time. I suffered during Christmas and New Year. I think I will be kind of sad this Chinese New Year.

Subscribe to:

Posts (Atom)

Latest Post

We have moved!

We have moved to a new website: www.jcprojectfreedom.com Visit us there!

-

One of good friend whom I grow up with approached me recently and asked me whether I will like to invest in CPU for bitcoin mining. He expl...

-

Assume I am addressing my stakeholders of JC Fund, I will mention the following. Today, I made a major switching of position by selling 20...

-

Just now, I experience a moment of fear. I remember recently in 2017, I experienced a fearful incident. I took the staircase in Internatio...