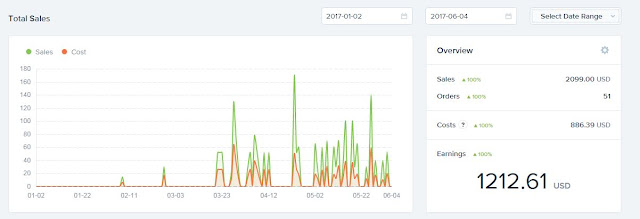

I finally have this afternoon to rest and reflect. I filed all my receipts, mails, and letters. It feels good to unclutter and get everything into my filing system to make things systematic. See below picture for four months of hard work from the team on our ecommerce store (my side business - another source of income). I was not able to contribute much due to my work commitment. I only worked on product fulfillment and customer services. We have not been able to achieve break even stage, the below figure does not include cost on Facebook marketing.

|

| Figure 1 - Revenue from ecommerce store |

|

| Figure 2 - Clear our mortgage |

I could have deployed the money to generate higher returns and complete our quest to achieve financial freedom earlier but it was a family decision. Recently I completed reading a classic book "100 to 1 in the stock market", it is a good book and I learnt a lot from it. This has shaped a new investment approach. I am trying to formulate whether I should take a more "income" approach or "growth" approach. If the company gives out dividend instead of retained earnings, it will be slower to grow. You cannot have the cake and eat it. If the company has a lot of cash, achieves low return on equity and does not give out dividend, the shareholders are worst off. In Singapore context, I will prefer the company to give out the dividend as I do not see very brilliant business owners as compared to Thailand, Asia and USA. At this moment, I have 60% of my portfolio in "income" stocks and maybe I should rebalance to position 70% in growth stocks.

Recently, I saw a few posts on a Facebook group discussing a topic on "30 years old and have 100k". I believe everyone is a winner if they are able to achieve financial freedom at 30, 40, 50, 60 or 70 years old. This is your own journey, it is never a competition. I just need to achieve SGD 2 m in my portfolio and I will call it a day. My mentor wants a SGD 10 m milestone. It depends on your lifestyle and ultimately how much do you need. I just want to have the freedom to choose my own lifestyle.

I tabulate JC Fund account and in May the Fund has achieved SGD 920k (cash position) and the fund should be able to cross the SGD 1,000k mark by end of 2017.

No comments:

Post a Comment